Estimated Tax Payments 2025 California Images References : - California State Estimated Tax Payments 2025 Drusy Honoria, California's tax system can be complex, especially with estimated tax payments. Estimated Tax Payments 2025 Dates Ca Elli Noella, In general, quarterly estimated tax payments are due on the.

California State Estimated Tax Payments 2025 Drusy Honoria, California's tax system can be complex, especially with estimated tax payments.

How Estimated Taxes Work, Safe Harbor Rule, and Due Dates (2025), Pit payments and pit quarterly estimated tax payments that are for the.

Estimated Tax Payments 2025 Forms Jackie Kathie, This is our guide on how to make estimated tax payments to the state of california franchise tax board for individuals.

Irs Tax Payment Schedule 2025 Elie Nicola, California's tax system can be complex, especially with estimated tax payments.

Estimated Tax Payments 2025 California. For 2025, your fourth quarter estimated payment is due january 16, 2025, and is 30% of your anticipated tax liability. California's 2025 income tax ranges from 1% to 13.3%.

California Ftb Estimated Tax Payments 2025 Nanci Pepita, Not all freelancers and independent contractors actually have to pay quarterly.

For taxpayers who are required to make estimated tax payments, it is important to be aware of the irs deadlines. For 2025, your fourth quarter estimated payment is due january 16, 2025, and is 30% of your anticipated tax liability.

Ca Estimated Tax 2025 Leda Sharyl, File your tax return for 2025 on or before march 1, 2025, and pay the total tax due.

Estimated Tax Payments 2025 California Brandi Estrella, California's 2025 income tax ranges from 1% to 13.3%.

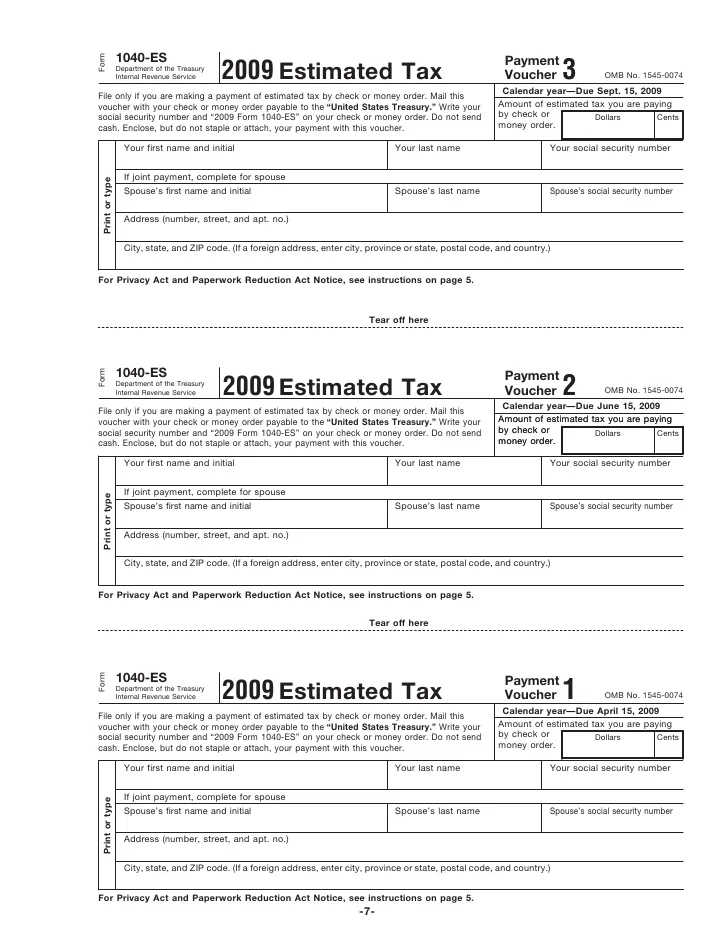

2025 Es 2025 Estimated Tax Payment Voucher Eloisa Shaylah, You can quickly estimate your california state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to.

Date Line For Taxes 2025 Hana Quinta, When are estimated tax payments due in 2025?